FOX Business enterprise contributor and chief economics correspondent for The Wall Avenue Journal Jon Hilsenrath argues bond marketplaces will not demonstrate warning symptoms of inflation.

A developing refrain of Wall Avenue strategists is warning the U.S. stock current market is ripe for a pullback as the COVID-19 delta variant spreads across the world amid the most complicated two-month stretch for buyers.

The S&P 500 has rallied 96% considering the fact that bottoming on March 23, 2020, reserving 61 record highs together the way. The benchmark index has throughout the rally prevented a correction, or drop of at least 10%, which occurs an normal of after a 12 months.

| Ticker | Protection | Past | Change | Transform % |

|---|---|---|---|---|

| SP500 | S&P 500 | 4395.26 | -23.89 | -.54% |

Strategists are growing more worried that the elusive pullback is coming now that the delta variant has threatened to derail the economy’s recovery.

“At this incipient phase of the distribute of the Delta variant and slowing of financial advancement, there are plenty of purple flags that prudent buyers have to start out thinking of de-risking,” wrote Scott Minerd, global chief investment officer at Guggenheim Associates.

FED’S Preferred INFLATION Examining Demonstrates Prices Bounce 3.5% Every year

A report released Thursday by the Commerce Division confirmed the U.S. financial state grew at a 6.5% yearly pace all through the second quarter, under the 8.5% fee that was anticipated. Economists say expansion will sluggish from the present-day rate as increasing rates and source-chain concerns keep on to disrupt the economy amid a flare-up in delta variant bacterial infections.

Minerd termed latest knowledge on the delta variant “really disturbing,” noting that the R0, or range of individuals who will be contaminated as a end result of a further contaminated person’s steps, was 6, this means it is two to three situations much more transmissible than the authentic COVID-19 strain.

With an normal of about 60,000 daily new situations that signifies that in six to 8 weeks there is possible to be much more than 200,000 new instances, like what was observed in December, he mentioned.

Fears over the delta variant have prompted the Centers for Disorder Control and Prevention to reinstate mask suggestions for so-named hotspots.

Economists and business leaders fear a return of masking will weigh on assurance and outcome in lessen sales, environment the stage for what is generally the worst extend of months for the inventory sector.

BIPARTISAN INFRASTRUCTURE Prepare IS THE ‘TROJAN HORSE’ FOR Large TAX Will increase

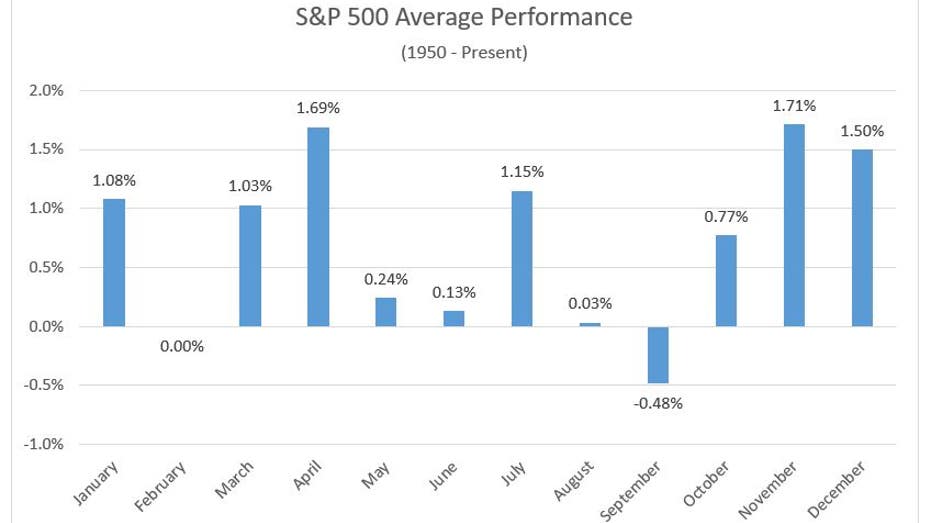

“Possibility is no doubt growing as we head into the troublesome August and September months,” wrote Ryan Detrick, main market strategist at LPL Economical.

Source: Dow Jones Marketplace Information

The complicated extend for the inventory market kicks off with buyers possessing to navigate narrowing breath, or less listings collaborating in the rally, and valuations in some situations stretched to degrees past viewed during the 1999-2000 tech bubble.

Michael Wilson, main U.S. fairness strategist at Morgan Stanley, was between the very first Wall Road analysts to voice considerations with regards to the underwhelming industry internals.

He believes investors need to “focus on relative price inside of the current market,” preferring superior excellent vs . reduced top quality stocks, consumer staples in excess of discretionary, health and fitness care above tech and defensives around cyclicals.

Wilson has a base-case yearend S&P 500 goal of 4,225, 3.87% beneath Friday’s closing degree. His bear scenario is for the S&P 500 to complete the 12 months at 3,800.

Although their figures are dwindling there are continue to bulls on Wall Road, but even they admit the stock current market is going through headwinds at these concentrations.

GET FOX Business ON THE GO BY CLICKING In this article

This is a “extremely logical time for the industry to gradual down” as earnings capture up with costs, Brian Belski, main investment strategist at BMO Capital Markets explained to FOX Business’ Stuart Varney on Friday. He has a yearend S&P 500 concentrate on of 4,500, or 2.39% previously mentioned where by the index closed on Friday.

“We are not calling for a deep correction like everybody else and their mom, brother, sister, cousin and uncle,” Belski explained. “We imagine the market place grinds bigger, but however good, quite positive more time time period.”